What will you say if I ask you how invested you are in the country’s development? You might laugh it off saying in lots of non-quantifiable ways. And now if I say that you can put a price to it? Yes. InvITshares are your answer to directly be invested in the infrastructural growth of the nation. Want to know more about it? Read on…..

Why InvIT?

If I run an infrastructure company, I am expected to have a huge stomach to wait for long years for my heavy investments to pay off. Typically, when an infrastructure company gets a contract, it starts generating revenues on it only after the project is completed. Needless to say requiring heavy capital investment. The company gets to enjoy the revenues only for a stipulated time, before handing the project to the government. This is known as a Build-Operate-Transfer or BOT model where the Infrastructure company incurs capex to build the project.

Companies generally opt for bank financing to fund these projects. Now, till the company doesn’t pay off the bank loan from the revenues from the project, the bank is resistant to extend more credit. This reduces the opportunity for the companies to pick up more projects and hence it costs them a lot of time, money and opportunities.

To give a way out of this jam, SEBInotified the SEBI(Infrastructure Investment Trusts) Regulations, 2014 on September 26, 2014, providing for registration and regulation of InvITs in India. Let’s understand how they work.

How it works?

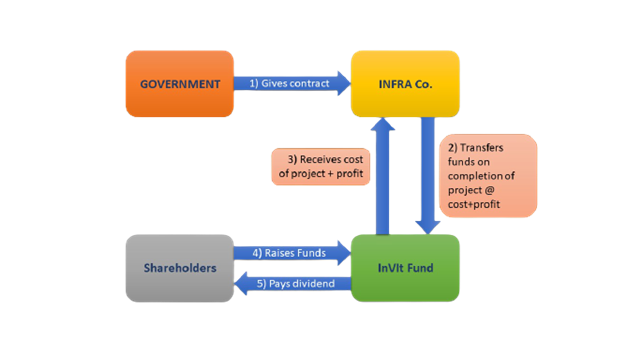

In the situation mentioned above, on completion of a project, infrastructure companies have an option to create a trust fund. This trust issues shares equating the discounted cashflow value of the project under concern, and raises finance from institutions as well as common public.These proceeds are used to pay the Infrastructure company in exchange of the assets worth the same amount. The revenue generated from usage fees i.e. tolls, service fees etc. is then passed on to shareholders as dividends after expensing the operational charges.

For example, say an infrastructure company X bags a contract to build a road worth Rs.100 cr. It arranges the fund of Rs.80cr from the bank. Let’s assume by the end of the project tenure interest accrued on bank loan is Rs.16 cr. Say the company targets to earn a profit of Rs.4cr, then the total funds needed at the end sums up to Rs.100 cr.

So company X creates a trust fund “INVIT” and transfers assets worth Rs.100cr in it. INVITarranges for financing this by creating 10,000 shares of Rs.1 lac each and issues them to institutions/ common public. Company Xpays off the bank with interest with these proceedings.

Let us assume forecasted revenue from the project is Rs.10.2cr per annum, for the next 20 years, after which the road would be transferred to government. The appropriate discount rate commensurate with the risk of the project is 8%.As revenue starts flowing in of Rs.10.2cr as forecasted, 8% of Rs.100cr (i.e. Rs.8cr) will go as interest and balance will go as capital return. Thus entire Rs.100cr will be amortized and paid off by end of 20 years, with shareholdersearning an 8% return every year.

So this way, on completion of the project the infrastructure company walks away with the money to repay the dues to the bank (Rs.96cr), take its profit home (Rs.4cr) and also scout for new projects. Wondering who are the other beneficiaries? Let’s see;

- Government: Work done in an efficient manner without raising additional capital

- Banks: Loans get cleared in a shorter time frame, thus ensuring liquidity

- Investor:Earlier either he/she would have to invest in infra company or through mutual fund which would subscribe to debt bonds. Either ways it would be an indirect investment. Now institutions/ retail investor can directly invest in infra projects, thus making a little extra money over other debt instruments.

- Trusts/InvIT Funds: Trusts are permitted to take up multiple projects and hence can have good liquidity. They are also allowed to raise debt in the debt equity ratio of 1:1, enabling them to expand their investment horizons. Steady revenues from infrastructure projects ensure a certain secured return.

REIT’s v/s InvITs

One comparable precedent to this model are REITs. Where the underlying asset in case of REITs is a residential/commercial project, for InvITs its infrastructure projects. REITs lure more investment for a simple reason, understanding of the risks and returns of the underlying asset. Forecasting costs and revenues of an infrastructure project can be challenging, vis-à-vis the realty sector.

How safe are InvITs?

The following rules about InvITs tackle the issue of safety:

- Mandatory distribution of 90% of net distributable cash flows to the unit investors

- Leverage cap of 70% on the net asset value

- A cap on exposure to assets under construction (for publicly placed InvITs)

- The sponsor of the InvITsets up the InvIT and appoints the trustee. The sponsor should hold a minimum 15% of the units issued by the InvIT, with a lock-in period of 3 years from the date of issuance.

- In 2019, capital market regulator Securities and Exchange Board of India reduced the minimum investment limits on InvITs to ₹1 lakh from the initial ₹10 lakh

- The Insurance Regulatory and Development Authority of India (IRDAI) has allowed insurers to invest in debt securities issued by InvITs with a condition that 75% of the investments have to be in AAA-rated assets, while 25% can go to instruments rated AA or even A-, but only after approval.

Despite of such an airtight mechanism, REITs are chosen over InvITs when it comes to investors. With better management and transparency, InvITs surely can be termed as a valuable investment. The latest InvIT is launched by Powergridwhich debuted at 4% premium on its IPO price today (14th May 2021). More such launches will increase awareness about this product, in turn building investor trust in them.

Acknowledgement: SoumitraMundada